Could Your Family Survive Without Your Income?

Could you continue to cover your basic day-to-day living costs, household bills, rent or mortgage repayments if you unexpectedly suffered an illness or had an accident that stopped you from working? You may be entitled to sick pay and benefits, however, these may only support you for a short period of time.

Many think this won’t happen to them, but it’s important to recognise that nobody is free from the risk of illness and accidents. So many do not consider how they would handle not having an income through disability and illness, or even the death of a partner, and the long-term effects this could have on their incomes.

A survey from Zurich found that people think the risk of them being unable to work due to illness or injury is less than 10%. However, research found that up to 25% of us could be affected, with very few being able to make ends meet if they lost their income.

This is where Income Protection Insurance comes in. Income protection is a long-term insurance policy to help support you if you can’t work:

- It replaces part of your income if you can’t work because you become ill or disabled.

- It pays out until you can start working again, or until you retire, die or at the end of the policy term (whichever is sooner).

- There’s a waiting period before the payments start. You generally set payments to start after your sick pay ends, or after any other insurance stops covering you.

- It covers most illnesses that leave you unable to work, either in the short or long term (depending on the type of policy and its definition of incapacity).

- You can claim as many times as you need to, while the policy lasts.

It could help safeguard you and your family against an unexpected loss of income so you have one less thing to worry about, leaving you to focus on your recovery. The plan will continue to support you until you are well enough to return to work, or until you reach the end of your plan.

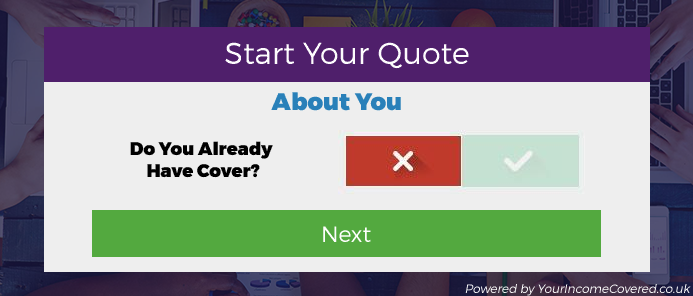

Find out how much your income protection cover could cost by applying for a free, no-obligation quote below…