How To Make 2020 Your Best Financial Year!

We are all guilty of making the same resolutions every year: spend less, save more. But how many of us can say we ever really stick to it? Luckily, we have compiled a helpful list of tips that will help you make 2020 a great year financially. Let’s begin..

Get Credit Score Savvy

Your credit score might seem like a trivial thing, but it is actually very important as it plays a huge role in many major financial situations throughout your life. Your score can impact your premium for many things, meaning the better your credit score, the less you will likely have to pay on loans/mortgages/insurance. There are many ways to get your credit score up, we recommend checking out the Credit Club from MoneySavingExpert.com to give you the best chances!

Get A Better Mortgage Deal

Many people don’t realise that remortgaging is a very common thing whereby you could get a much better deal and save your family hundreds. It is beneficial to see if there are better deals available with lower interest rates and it is actually very easy to do. Websites such as Remortgage Searcher help you find the best rate – after all, it could bring your monthly repayments down so you have some extra cash to book that summer holiday!

Set A Goal

Everybody says they want to save more in the New Year, but it’s often way harder to do in practice, especially with such an open goal. Some saving regimes work for some but are unachievable for others. The easiest and most realistic way to save is to actually give yourself a figure to work towards. For example, you might set yourself the goal to save £4,000 by October. You can then choose to budget any way you find simplest to reach this objective.

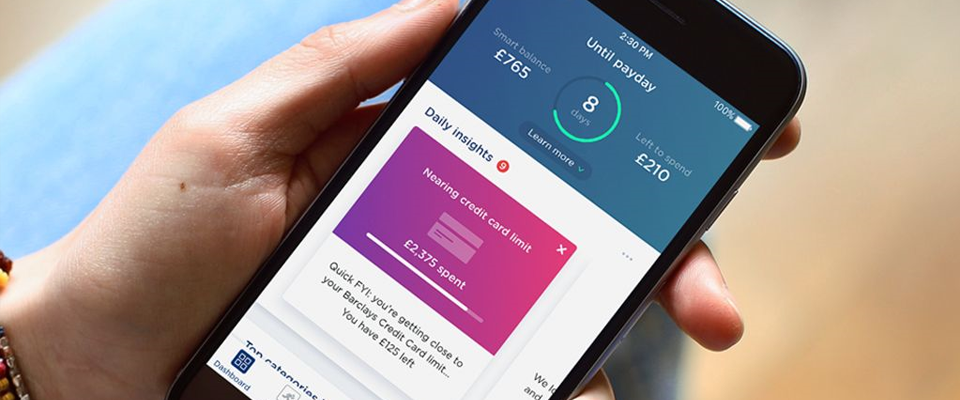

Analyse Your Spending

We can all admit we spend too much on things like coffee and takeaways, but it often doesn’t hit home until you realise how much per month or per year you are spending on these things. This is where finance tracking apps like Yolt come in really handy. It groups your spending into different categories so you can see exactly how much you spend on each thing. You can then work on reducing your outgoings for specific things rather than in general!

Make Your Money Work

If you haven’t already, definitely look into putting money away into an ISA savings account. They are tax-free so are the best way to get the most out of the money you are putting away. Easy access ISAs are low commitment too as you can withdraw money at any point if you need to. Have a shop around to see which banks offer the best interest rates to get your 2020 savings off to the best start!