MANY PEOPLE IN BRITAIN ARE NOW CHOOSING LIFE INSURANCE

last updated 6th November 2017

Life insurance can provide affordable financial protection for those who rely on your support every day. It helps guarantee that your loved ones will be covered if anything happens to you in the future.It’s hard enough dealing with the loss of a loved and financial worry shouldn’t have to be another factor that they have to think about.

Many people have now opted into taking out life insurance, which was perhaps wasn’t such a common practice in the past, as many people didn’t know or understand the benefits that come from life insurance. Lack of life insurance sadly left many families in financial crisis after the main financial provider passed, leaving families with inherited debts as well as not being able to keep up with the everyday financial demands of life.

The solution is to plan for the future and this is what life insurance does. It helps you plan for the time you may not be around making sure that your family are still financially able to cope. we can definitely say that it has helped families all over Britain and there are certainly more reasons to get life insurance than there is not too.

How Life insurance can help

![]() Protect your loved ones from inheriting your debts like mortgages, funeral costs. school fees, car debts etc

Protect your loved ones from inheriting your debts like mortgages, funeral costs. school fees, car debts etc

![]() Peace of mind once you’ve gone.

Peace of mind once you’ve gone.

![]() You can choose an affordable cover that won’t sink your pocket.

You can choose an affordable cover that won’t sink your pocket.

![]() Fixed premiums

Fixed premiums

Whats different about Life insurance then and now?

In today’s world where internet is so accessible and there is so much competition out there for insurance companies, many of them have no choice but to reduce their rates, making life insurance a more affordable for everyone. However many people don’t realise this and so still believe that life insurance has to break the bank. If you find the right deal life insurance can cost as little as a few cups of coffee each week! That’s where we come in!

With Your LifeCovered.co.uk you can relax as we will do all the work for you and find the perfect life insurance policy to suit your needs. What’s so great about this is that its completely free and only takes about 3 minutes to fill in!It’s no wonder why so many people are saving money since you are now able to use this simple tool rather than spending weeks trying to contact and compare options alone.

How to get started

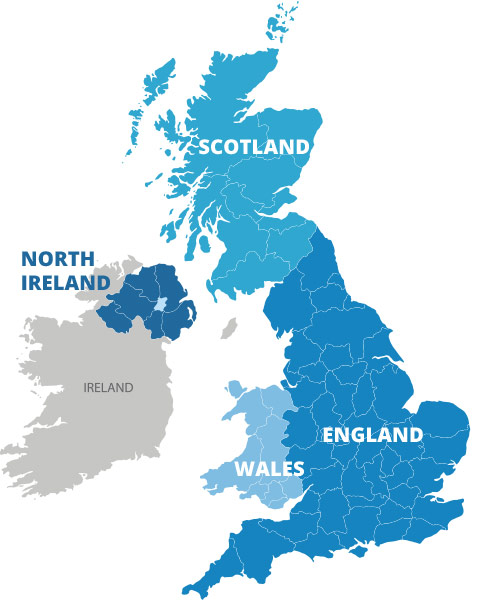

Step 1: Click on your country below

Step 2: Once you go through a few questions, we will work on tailoring your quotes to you from the UK’s top providers

We think it's important you understand the strengths and limitations of the site. We're a journalistic website and aim to provide the best Money Saving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. This info does not constitute financial advice, always do your own research as well to ensure it's right for your specific circumstances and remember we focus on rates not service. We often link to other websites, but we can't be responsible for their content. This site is in no way affiliated with any news source. As mentioned above it is an advertisement. This site contains affiliate and partner links. Any testimonials on this page are real product reviews, but the images used to depict these consumers are used for dramatization purposes only. This website and the company that owns it is not responsible for any typographical or photographic errors. If you do not agree to our terms and policies, then please leave this site immediately. All trademarks, logos, and service marks (collectively the "Trademarks") displayed are registered and/or unregistered Trademarks of their respective owners. Contents of this website are copyrighted property of the reviewer and/or this website.

© Copyright Your Money Saving 2021 - All rights reserved